The other day I noticed a graph that really got me thinking. Here it is:

Asset prices have become unmoored from GDP. Notice that the person who added the annotations (maybe here?) interprets this as a series of “bubbles.” And the most recent bubble is cause by the actions of the central bank (i.e., the Fed).

In some ways, the existence of these bubbles is obvious. I mean, you can clearly see it on the graph! But then I asked myself: what should the price of assets be with respect to national income?

Golden Goose

To answer this question I came up with a simple thought experiment that I call the Golden Goose. Imagine that you have a goose that lays one golden egg every year, and will continue to do so forever (i.e., it’s immortal). Assume for a minute that each egg is worth $10,000 in today’s dollars (i.e., we are going to ignore CPI inflation). What is the goose worth?

Well, all you have to do is add up the future income, and then discount it. Since we are ignoring inflation, the discount rate is equal to the real interest rate. So let’s give you an idea of the range. If the discount rate is 100%, according to the net present value formula, the value of the goose is $10,000 .

If the discount rate is 50%, the value of the goose is $20,000, and 10% gives $100,000. If the discount rate is 1%, the value goes all the way up to $1,000,000. See the pattern? More or less, all you have to do is divide $10,000 by the discount rate.

So here’s where things get pretty interesting. As the discount rate gets close to zero, there is no limit to the value of the goose! So if you don’t discount future payments, the value of the goose is infinite!

Real Interest Rate Trends

So now let’s go back to the first graph. If the real interest rate hasn’t changed, we are indeed in a bubble because the value of our goose (i.e., the sum of the assets) has increased relative to the price of our eggs (i.e., GDP). But, should we assume that real interest rates are constant?

Well, I looked around and found this interesting graph:

The source argues that real interest have been falling towards zero (and sometimes below zero) for the last 700 years!

How many economic trends do you know of that have been going steady for 700 years? If this is true (and I think it might be) we are about to reach (or are in the midst of) an economic singularity, where real interest rates reach zero, perhaps permanently.

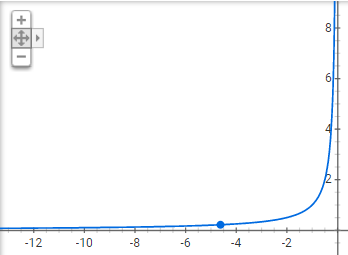

And what should we expect during an economic singularity? Quickly rising asset prices:

And notice that as you get closer to zero, the asset prices rise faster and faster. If real interest rates are really approaching zero, we should expect asset prices to become unmoored from GDP, and we should expect that the process is going to accelerate regardless of what the Fed does.

In other words, if we are approaching the economic singularity, the “bubble” isn’t being caused by the Fed pumping money into the economy (although it certainly does seem like they are doing that). The ‘bubble” is cause by a centuries (or maybe even millennia?) old economic trend.

The Cause of the Trend

So what could possibly explain a long-term trend toward zero interest rates? What else? Technology! As time has progressed, humanity’s time horizons have expanded as technology has enabled us to cooperate to solve bigger and more complex problems.

One simple way of looking at things is that hunter gatherers were mainly concerned about today’s dinner. Agricultural humanity was concerned about this year’s harvest. In the computer age we are concerned with things like climate change and galactic exploration. It seems only natural that as the scale of our problems gets bigger, and our time horizons get further out, the extent to which we discount the future will decrease. Thus, real interest rates will fall.

And we can probably expect the trend to continue. I doubt that interest rates will ever actually be zero in equilibrium (although occasionally they will actually fall below zero in the short term). But the size and scope of human civilization will probably continue to increase. On some measures, we are barely even on the scale yet:

What kind of time horizon (i.e., how far into the future people plan) would we need to become a type II civilization? Not exactly sure, but it would probably be on the scale of centuries, if not millennia. This could imply real interest rates that are much closer to zero than they are today.

Moloch

So what does all this mean? If real interest rates fall, asset prices will continue to grow at a higher rate than incomes or consumer goods. So everyone gets a 70" TV and an iPhone, but no one can afford to own a house without borrowing.

Of course, with interest rates low, everyone who can be trusted will be able to borrow money very easily. So, for example, maybe the standard 30 yr mortgage will become a 50 yr mortgage, or eventually a 100 yr mortgage. Maybe at some point mortgages will even have infinite time frames. So, for example, the average house of the future might cost $1T in todays dollars, and is paid for with an infinite mortgage with payments similar to the cost of local rents in the area (which will be mainly determined by status considerations).

Of course, if you have mortgage that you can never pay off, you don’t really own your house, do you? And this is my prediction, as time goes on it will be easier than ever to consume, and harder and harder to really own anything outright. Those who do own assets will see their wealth grow very fast, but there will always be someone who owns more and whose wealth is growing faster.

So on some measures, poverty will be eradicated. But economic inequality will continue to rise. Sound familiar? It’s because this trend has been going on since the beginning of time, and unless it is interrupted by something (say, an AI singularity, a giant asteroid, or the entropy death of the galaxy) things in the future are going to be just like they are today, only more so.

In the meantime, let’s just appreciate the fact that there is so much cheap and amazing stuff to consume. Also, if you have a high tolerance for risk, you should be willing to borrow more to invest in assets (like real estate, stocks, or golden geese).

But most importantly of all, for me, is that we must be able to compartmentalize status competition. The top rung of the economic ladder is going to become more and more out of reach (for virtually everyone), and the ever increasing size and efficiency of consumer markets is going to make it easier and easier to get by without human-scale cooperation. In other words, the rat race is going to get more intense, and people are going to get more lonely. Again, more of the same.

In the words of Scott Alexander, the future will be ruled by Moloch. If you haven’t read that essay, you really should. The term Moloch is used to refer to the fact that technological growth will enable humanity to make tradeoffs that will simultaneously make our lives better and more efficient, but also worse and less meaningful. Falling interest rates are a sign of the coming of Moloch and, according to that 700 year graph, he is now at the gates.

The one potential solution Scott Alexander proposes (and critiques) is to build a “walled garden.” I prefer the analogy of an ark. Gather closely the minimum viable pieces for psychological thriving, and then float on stormy seas. For me the ark is a human-scale community, or micro-community. Within these communities, human life will be better than ever. But those who try to swim in the ocean alone will be torn apart by the coming storms.

And no, I don’t blame all of this on the Fed. Moloch will not be held at bay by any national interest rate policy. This is bigger than the Fed. So quit complaining about economic bubbles, and start building a social bubble.